how flat money could help resist inflation - from an argentinian perspective

How DeFi protocols can help people in countries with economic instability.

Growing up in Argentina, I've experienced my whole life the economic turbulence that defines our country. Historically, Argentina’s currency has been plagued by high inflation rates, deeply affecting our daily lives. The value of our local currency fluctuates, making financial planning a challenge. This constant economic uncertainty impacts everyone, from small business owners to families trying to budget their monthly expenses.

Imagine living in a country where your salary is devalued by a large percentage every day, the price of everything increases week by week, and you have no financial stability in any sense. That defines Argentina.

Introducing Flat.Money Protocol

There are many protocols floating around in the DeFi ecosystem, but when we talk about inflation, economic issues, etc., I especially like the idea of a protocol like Flat Money as it can be a useful tool for people who need to deal with these financial problems every day.

In this climate of financial instability, the Flat Money Protocol emerges as a potential beacon of hope. It's a protocol that could help us navigate through these turbulent economic waters.

Its purpose is simple yet powerful: to provide a new kind of asset, a flatcoin, that isn’t devalued by inflation and brings financial stability to our lives.

What makes Flat Money stand out in the fight against inflation? Well, basically their inflation-resistant coin. This feature is particularly relevant for this case. It offers a semblance of stability in an otherwise volatile economic environment.

How Does Flat.money Work

You may wonder how this protocol works, and it's actually quite simple and clever. If you’re into DeFi you’ll understand it easily - but let's talk about it.

Flat Money's Flatcoin operates on a principle of balancing risk and stability in the face of inflation. The key to this balance is the creation of a delta-neutral position. This is achieved by pooling wstETH (wrapped staked Ethereum) from various Liquidity Providers (LPs). Alongside this, Flatcoin establishes short positions in Ethereum's market using perpetual contracts. This dual approach is crucial as it helps in significantly reducing the LPs' exposure to Ethereum's price fluctuations.

So basically it operates based on these key points:

It maintains a delta-neutral position dynamically through a funding rate mechanism.

The funding rate is applied to Leveraged Traders (LTs) who use leverage to amplify their market positions via perpetual futures contracts.

This funding rate changes according to market conditions, affecting the cost for LTs to maintain their long positions.

As LTs increase their long positions, Flatcoin holders automatically assume an equivalent short position, crucial for keeping Flatcoin's delta-neutral status.

The yield comes from funding rate LTs and trading + liquidation fees from LTs.

If LTs' long positions exceed the collateral in Flatcoin, Flatcoin holders take a net short position.

This results in Flatcoin holders receiving funding rate payments from LTs.

This system is designed to generate yields for Flatcoin holders, serving as a hedge against inflation in economies with volatile currencies.

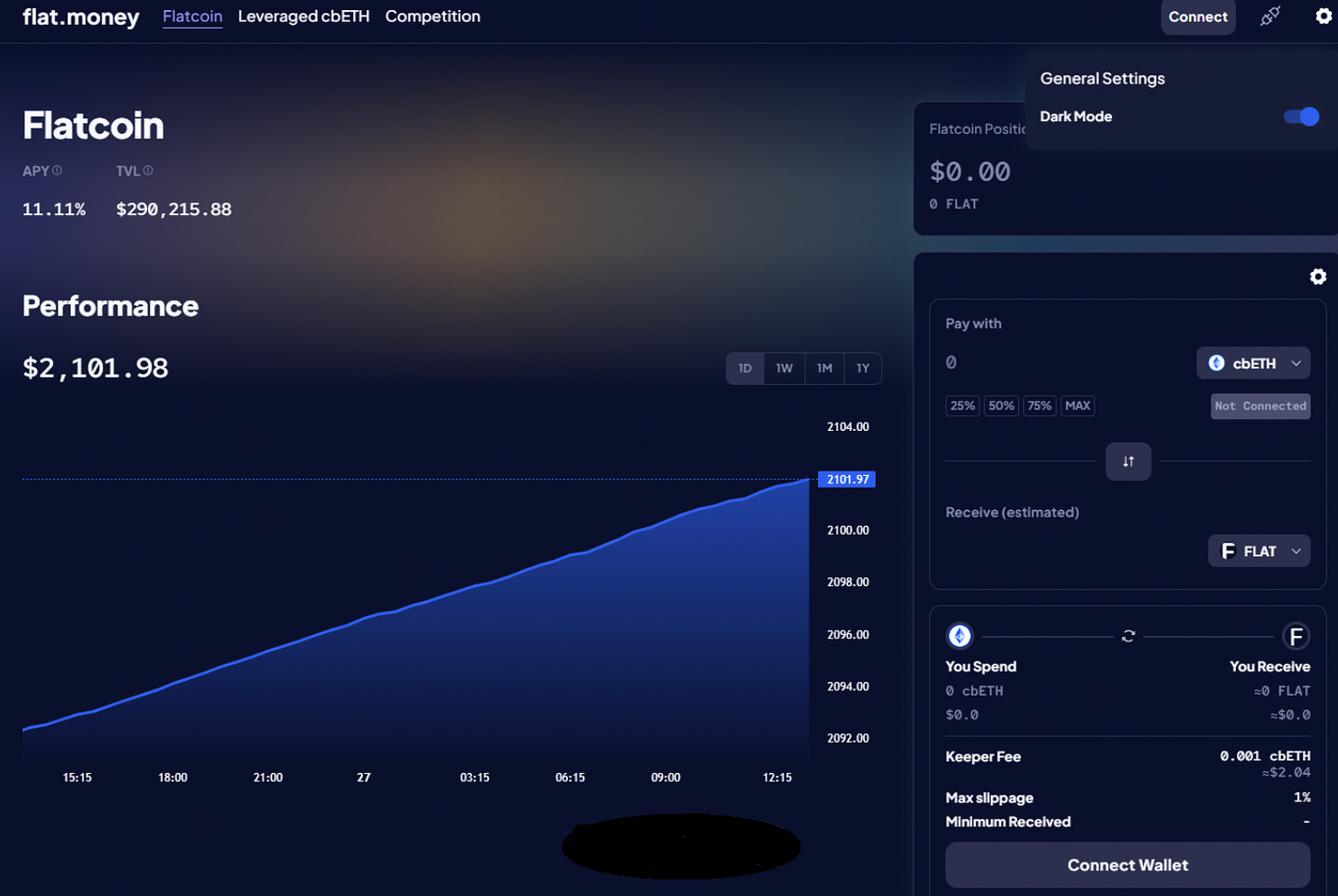

Getting Started with Flat Money

To mint Flatcoin, you'll need wstETH, which is a token representing a liquid staked ETH position. Remember that they are on testnet.

Providing Liquidity with wstETH

The minting process begins with providing liquidity to the Flat Money protocol using wstETH. This step is crucial as it's the foundation upon which Flatcoin is minted. If you're new to this, providing liquidity might sound complex, but it essentially means you're supplying the protocol with the necessary assets (in this case, wstETH) to function.

Minting and Managing Flatcoin

Once you deposit your wstETH, Flatcoin tokens are minted. This process is akin to exchanging your wstETH for Flatcoin. It's important to note that these Flatcoin tokens get burned (or destroyed) when you decide to redeem or withdraw them, ensuring a balanced ecosystem. Additionally, there's a withdrawal fee of 0.3%.

Wrapping it Up

From my perspective, as someone who has lived through Argentina's economic ups and downs, Flat Money seems like a useful tool for those who are into DeFi. Its stability and ease of use could make it a practical tool for everyday transactions, providing an alternative to unstable currencies in general.

I recommend you to explore Flat Money’s docs and protocol (remember they’re in testnet). Nowadays our financial stability is constantly challenged, so I find it important to be open to new solutions and I’m particularly bullish on DeFi and protocols like this one.